On 26 November 2025, leading thinkers, policymakers, philanthropic organisations, and development partners gathered at the OECD Headquarters in Paris for the Third Edition of Africa Philanthropy Day. Hosted under the theme “Co-Investing in Africa’s Future: Aligning Philanthropy with Domestic Resource Mobilisation (DRM)”, the convening explored one of the most pressing questions shaping Africa’s development outlook:

How can philanthropy strengthen Africa’s ability to fund its own priorities?

The event was co-hosted by the OECD in partnership with prominent African and global institutions, including the Centre on African Philanthropy and Social Investment (CAPSI), Africa Capacity Building Foundation, African Philanthropy Forum, East Africa Philanthropy Network, Mo Ibrahim Foundation, Agence Française de Développement, Ecobank Foundation, Giving Tuesday, the Rockefeller Foundation, the Tony Elumelu Foundation and others.

With the African continent experiencing shrinking aid flows, rising debt repayments, and widening financing gaps, speakers emphasised that African-led solutions, domestic resources, and inclusive partnerships are now more critical than ever.

A Changing Development Landscape

The discussion drew heavily on insights from the OECD/African Union Commission’s 2023 Africa’s Development Dynamics Report, the 2025 Seville Compromise, and ongoing global shifts highlighted in G20 conversations.

Africa currently faces:

- An annual USD 194 billion sustainable financing gap,

- External debt exceeding USD 650 billion, and

- A steady decline in Official Development Assistance (ODA), projected to drop by 9–17% in 2025.

At the same time, Africa loses an estimated USD 100 billion per year to illicit financial flows—funds that could otherwise support health, education, infrastructure, and youth employment.

These realities threaten progress toward the Sustainable Development Goals (SDGs), particularly SDG 1 (No Poverty), SDG 8 (Decent Work and Economic Growth), SDG 10 (Reduced Inequalities), and SDG 17 (Partnerships for the Goals).

Against this backdrop, participants emphasised the growing importance of Domestic Resource Mobilisation, including tax revenues, remittances, pension funds, sovereign wealth funds, community giving, and philanthropic flows.

Prof Bhekinkosi Moyo: “Africa has enough resources. We must govern and deploy them wisely.”

In the opening high-level panel, Professor Bhekinkosi Moyo, Director of CAPSI and Adjunct Professor at Wits University, stressed that African countries possess far more resources than is often acknowledged.

He stated:

“In hosting the 3rd Africa Philanthropy Day, the OECD collaborated this year with key African institutions, including CAPSI. In my presentation, I emphasised the need to take stock of all African resources, govern them accordingly, and deploy them towards the transformation of the continent. There are enough domestic resources across Africa to sustain the population; they need to be harnessed and mobilised for the public good.”

Professor Moyo highlighted that while philanthropy has not traditionally been positioned as a central pillar of DRM, it is well placed to strengthen the ecosystem through evidence, capacity building, community mobilisation, and innovative partnerships.

He noted that local philanthropy—rooted in traditions such as rotating savings groups, communal support systems, remittances, and faith-based giving—is an overlooked but powerful source of development finance.

The Role of Remittances, Local Giving, and Community Capital

Africa receives some of the highest remittance flows in the world. According to IFAD, one in five Africans sends or receives international remittances, not counting domestic transfers. Yet, these funds remain vastly underutilised in national development strategies.

Speakers discussed opportunities for philanthropy to work with governments and financial institutions to expand the value of these flows, including through:

- Diaspora bonds,

- Digital giving platforms,

- Structured community funds, and

- Cross-border financial innovations.

Philanthropy can also strengthen mechanisms that connect grassroots giving to national priorities—helping scale what already works, rather than prescribing external solutions.

Ambassador Mzukisi Qobo: “Agriculture needs long-term, sustainable investment rooted in local ownership.”

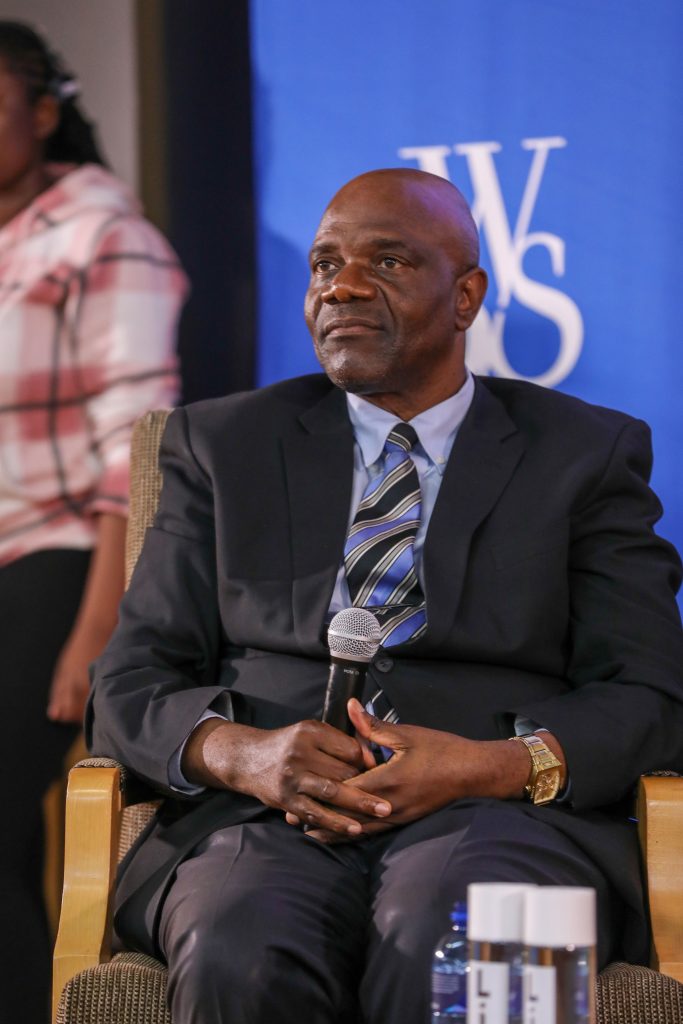

A key contribution came from Dr Mzukisi Qobo, South Africa’s Ambassador and Permanent Representative to the World Trade Organisation, who served as a speaker in the workshop on investing in Africa’s agricultural future.

Qobo, who is also an associate of CAPSI and the former Head of the Wits School of Governance—which he continues to be associated with—emphasised the structural barriers smallholder farmers face.

“Smallholder farmers are often excluded from formal credit systems and climate-smart investment opportunities. Public–Private–Philanthropy Partnerships can play a role by catalysing more investment.”

He outlined the breadth of support required:

“Access to finance is critical, but there is also the need for non-financial support, including training and development, extension services, storage and warehousing, and building networks and markets.”

Ambassador Qobo argued that de-risking agriculture through credit guarantees and insurance schemes could increase private-sector appetite for long-term agricultural finance.

He added:

“Philanthropy can support by participating in co-investment and blended finance initiatives. Still, success requires developing the capabilities of smallholder farmers—from production to aggregation and marketing. External actors must ground their strategies in the local context and support local ownership.”

His insights strongly connect to the G20’s emphasis on inclusive growth, food security, and local ownership, reinforcing the need for financing models that are sustainable, community-driven, and long-term.

Domestic Resource Mobilisation and Locally Led Development Must Work Together

Speakers noted that DRM and Locally Led Development (LLD) are deeply interconnected:

- DRM provides the resources, sovereignty, and financial base.

- LLD ensures resources are used in ways that reflect local priorities.

- Philanthropy bridges the gap through innovation, capacity building, and partnership facilitation.

Examples shared included:

- Supporting national tax systems,

- Strengthening data and research,

- Building advocacy networks,

- Amplifying youth and women-led organisations, and

- Reinforcing transparency and accountability.

This systems approach also aligns with SDG 17, which calls for stronger global partnerships and resource mobilisation.

Toward a Shared Path Forward

The convening closed with a call for co-investment models, stronger Public–Private–Philanthropy Partnerships, and sustained platforms for collaboration.

Participants agreed that Africa’s future depends on:

- Harnessing its own resources,

- Strengthening domestic institutions,

- Mobilising community and diaspora capital, and

- Ensuring that development is locally led and locally owned.

The event reaffirmed that philanthropy is not a replacement for public financing—but a catalyst, partner, and innovation driver.

As Africa repositions itself in the global development landscape, and as global institutions like the G20 reflect on more equitable financial systems, initiatives such as Africa Philanthropy Day signal an important shift toward African agency, African priorities, and African leadership.